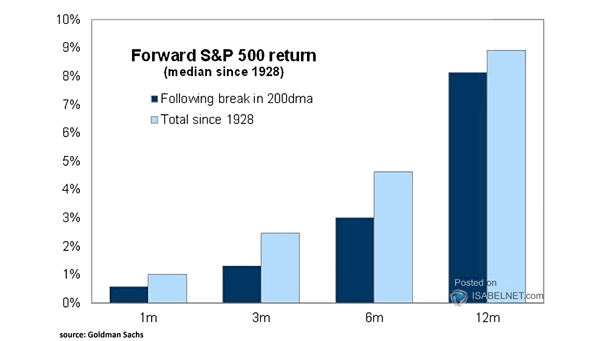

Forward S&P 500 Return Following Break in 200-DMA

Forward S&P 500 Return Following Break in 200-DMA Staying above the 200-day moving average may provide higher forward returns for the S&P 500 index, indicating positive market momentum and potentially leading to favorable investment outcomes.…