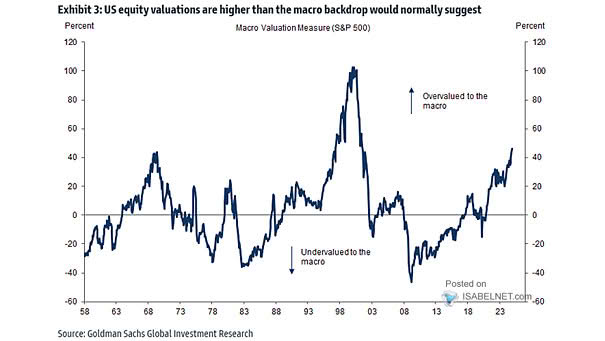

Market-Implied U.S. Recession Probability

Market-Implied U.S. Recession Probability With the market pricing a 16% chance of a U.S. recession in the next 12 months, recession risk remains modest and broadly in line with a moderate-risk environment. Image: Goldman Sachs…