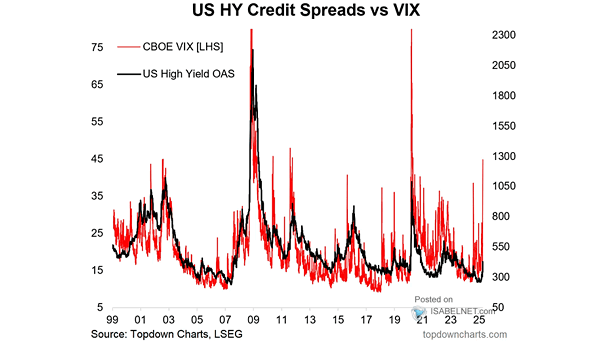

U.S. High Yield Credit Spreads vs. VIX

U.S. High Yield Credit Spreads vs. VIX Investors are pricing high-yield credit as if the good times will roll on. Spreads are tight, fundamentals look firm, but that very optimism risks shading into complacency. Active…