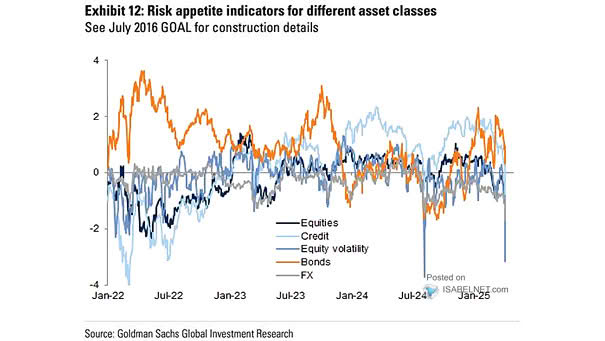

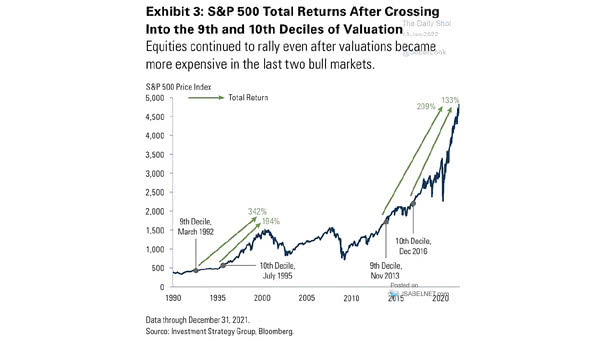

Risk Appetite Indicator for Different Asset Classes

Risk Appetite Indicator for Different Asset Classes Investors’ appetite for equities has surged, showing signs of overheating and leaving little margin for error. Image: Goldman Sachs Global Investment Research