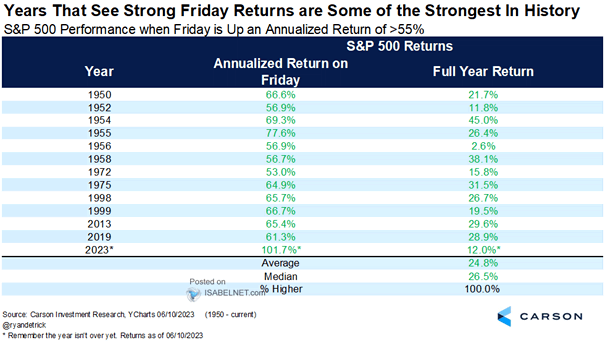

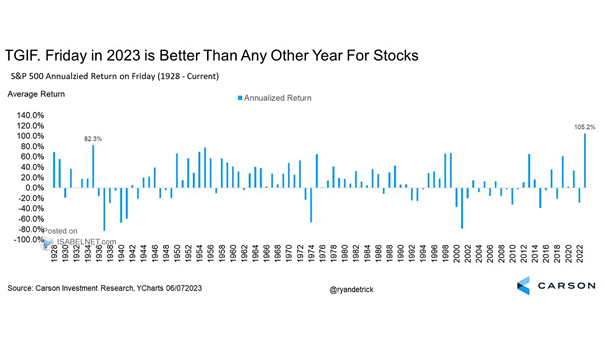

S&P 500 Performance when Friday is Up an Annualized Return of >55%

S&P 500 Performance when Friday is Up an Annualized Return of >55% Historically, bulls smile when the S&P 500 is up more than 55% on Friday on an annualized return. Image: Carson Investment Research