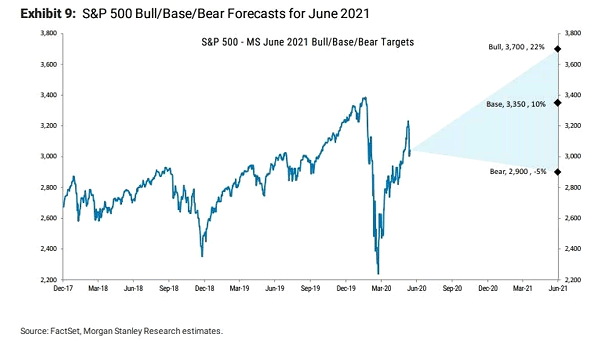

Russell 2000 Annual EPS Growth

Russell 2000 Annual EPS Growth Analysts are betting big on 2026, forecasting a 60% surge in U.S. small-cap earnings, fueled by Fed easing, deregulation, and fiscal tailwinds. Image: Goldman Sachs Global Investment Research