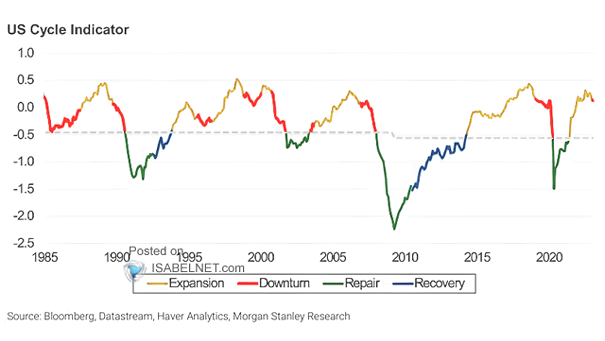

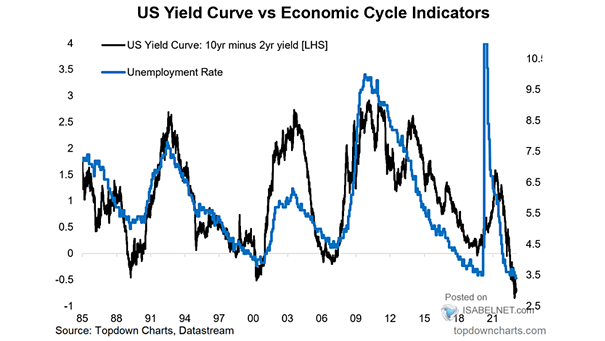

U.S. Business Cycle – Cross-Asset Cycle Indicator

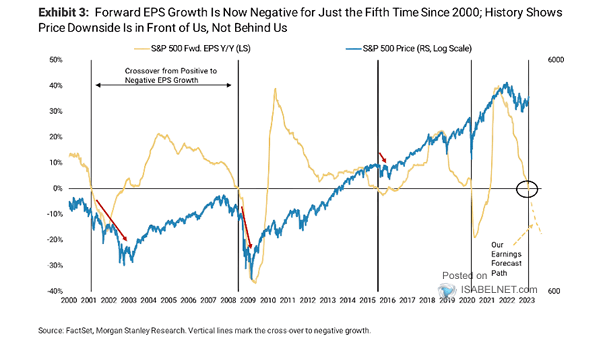

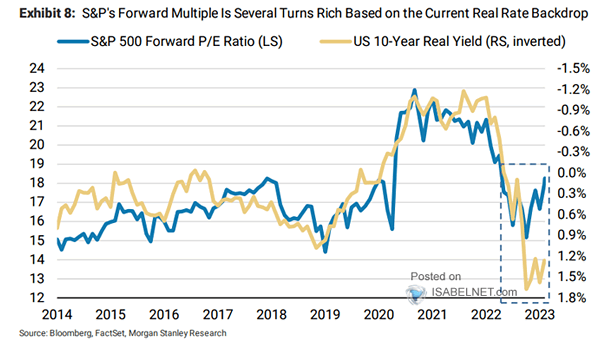

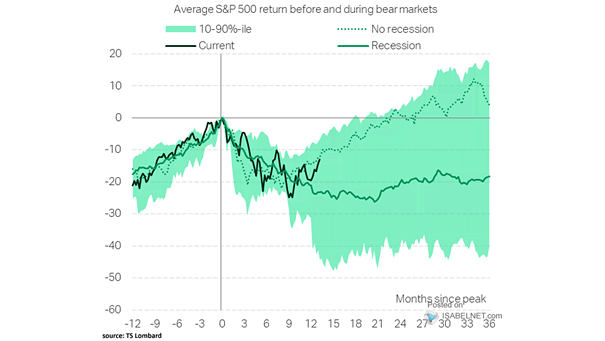

U.S. Business Cycle – Cross-Asset Cycle Indicator The Morgan Stanley’s U.S. cycle indicator has moved into the downturn phase. Should investors favor fixed income over equities? Image: Morgan Stanley Research