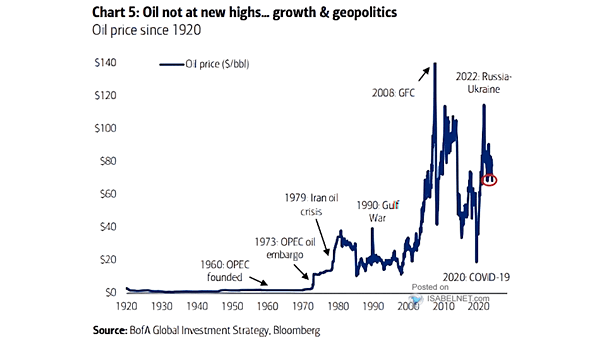

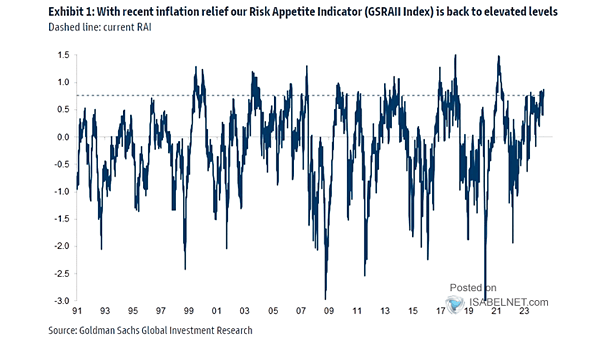

U.S. Inflation: 1970 vs. Today

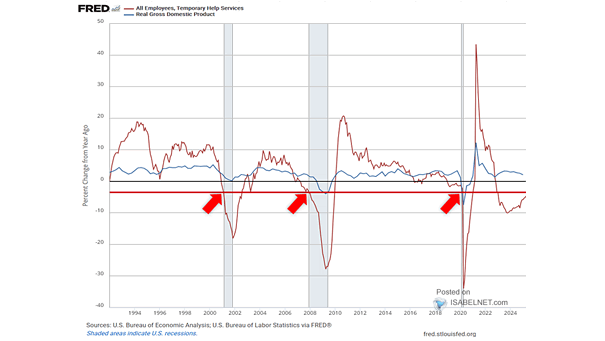

U.S. Inflation: 1970 vs. Today The modern economy shows greater resilience to inflation pressures compared to the 1970s, but whether it avoids stagflation depends on how long the current geopolitical conflict lasts. Image: Deutsche Bank