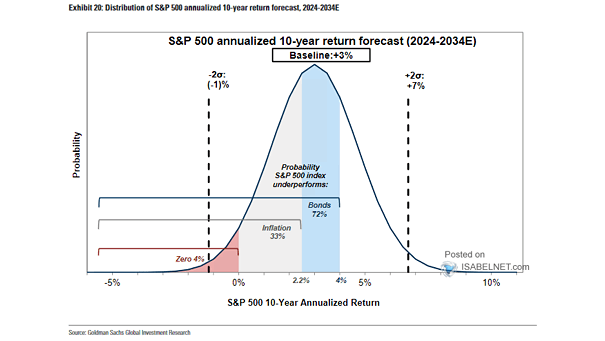

Equities – 10-Year Forward Annualized Total Returns in Local Currency

Equities – 10-Year Forward Annualized Total Returns in Local Currency Rich valuations aren’t stopping Goldman Sachs from backing global equities, with Emerging Markets and Asia seen leading performance over the next 10 years. Image: Goldman…