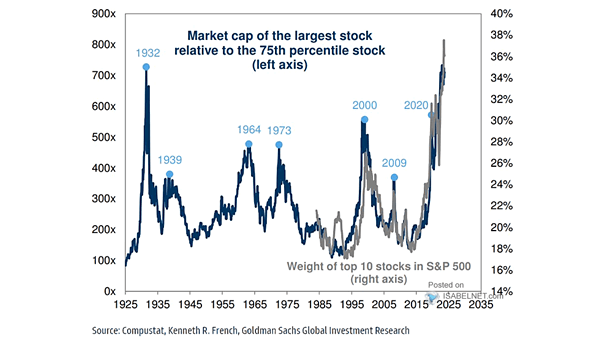

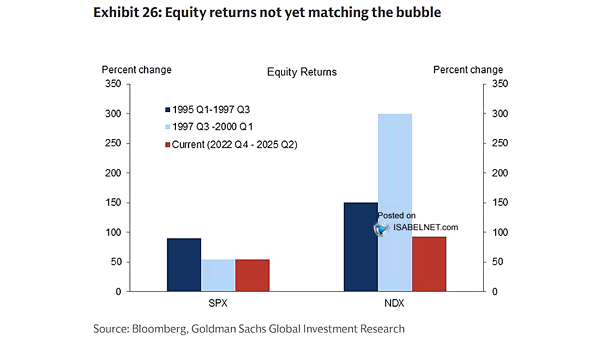

Market Capitalization of the Largest Stock Relative to the 75th Percentile Stock

Market Capitalization of the Largest Stock Relative to the 75th Percentile Stock U.S. stocks are more top-heavy than at any point in nearly a century, with mega-cap tech driving the charge. The dominance is juicing…