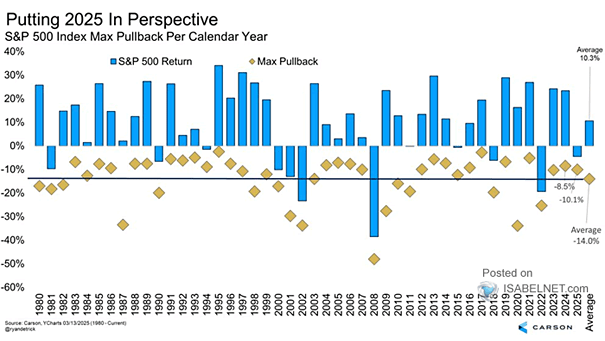

S&P 500 Returns into Year-End Following >15% Through October

S&P 500 Returns into Year-End Following >15% Through October When Wall Street catches fire, it usually keeps burning. In years when the S&P 500 has already surged more than 15% by late October, it has…