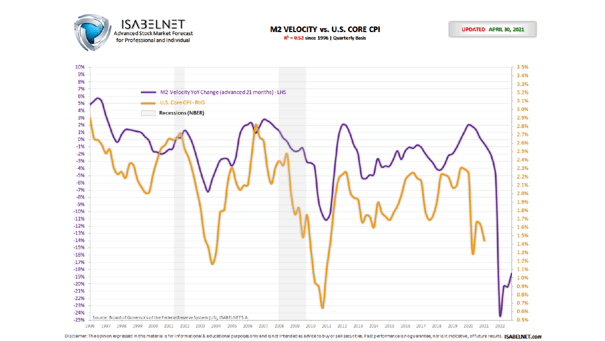

U.S. Core Inflation Expected Over the Next 21 Months (Leading Indicator)

U.S. Core Inflation Expected Over the Next 21 Months (Leading Indicator) M2 velocity year-over-year tends to lead U.S. core CPI by 21 months (R² = 0.52 since 1996). It has been quite accurate for more…