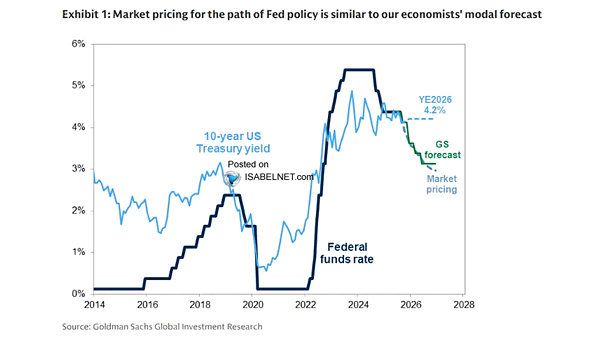

Fed Funds Rate and 10-Year U.S. Treasury Yield

Fed Funds Rate and 10-Year U.S. Treasury Yield The S&P 500’s record-breaking rally shows no signs of cooling, with market participants now positioning for another Fed rate cut on October 29 to fuel the next…