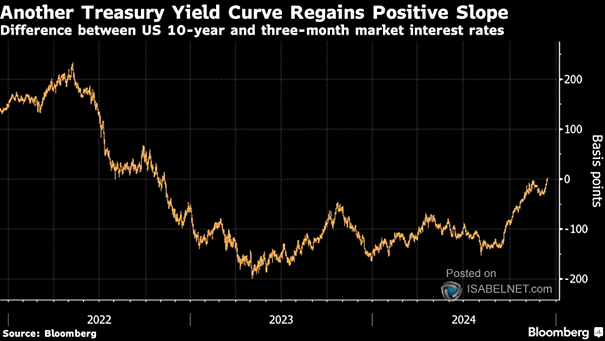

U.S. 10Y-3M Yield Curve and Recessions

U.S. 10Y-3M Yield Curve and Recessions The U.S. 10Y-3M Treasury yield curve has been a reliable recession risk indicator, but every economic situation is unique and historical patterns may not repeat exactly. Image: BofA Global…