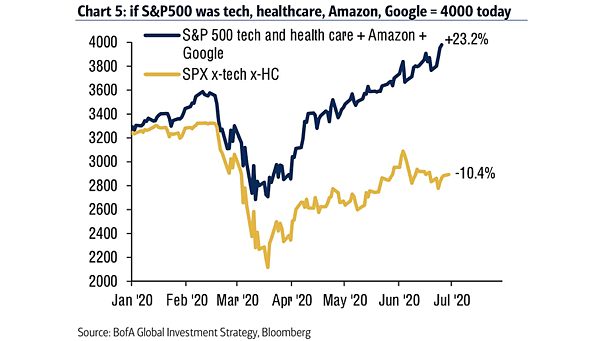

S&P 500 Tech and Health Care + Amazon + Google vs. S&P 500 Excluding Tech and Health Care

S&P 500 Tech and Health Care + Amazon + Google vs. S&P 500 Excluding Tech and Health Care This chart highlights the outperformance of S&P 500 YTD (tech and health care + Amazon + Google)…