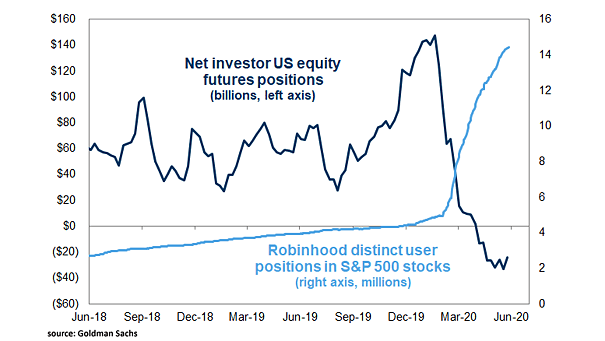

Net Investor U.S. Equity Futures Positions vs. Robinhood Distinct User Positions in S&P 500 Stocks

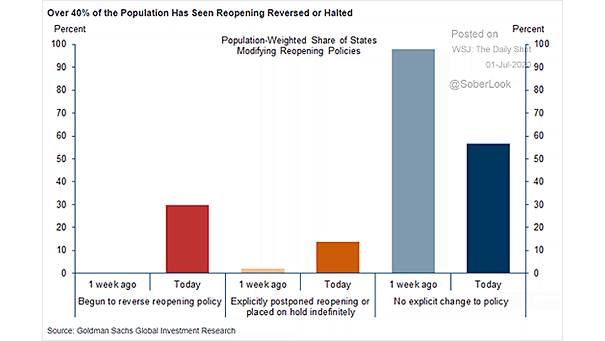

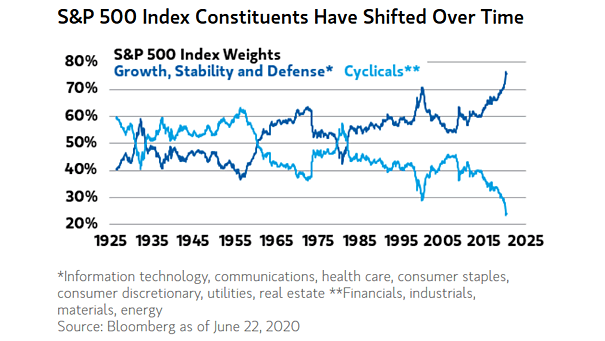

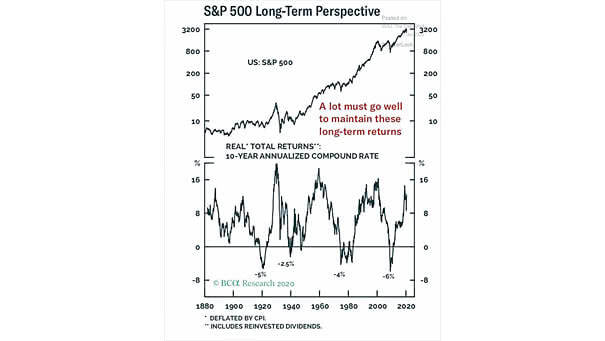

Net Investor U.S. Equity Futures Positions vs. Robinhood Distinct User Positions in S&P 500 Stocks Is this going to end well? Goldman Sachs is starting to worry about valuation. Image: Goldman Sachs Global Investment Research