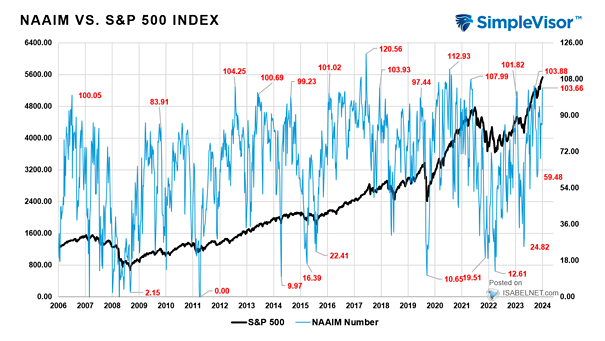

NAAIM vs. S&P 500 Index

NAAIM vs. S&P 500 Index Active investment managers, with their portfolios fully invested in equities, are often criticized for their consistent habit of selling at market bottoms and purchasing at market tops. Image: Real Investment…