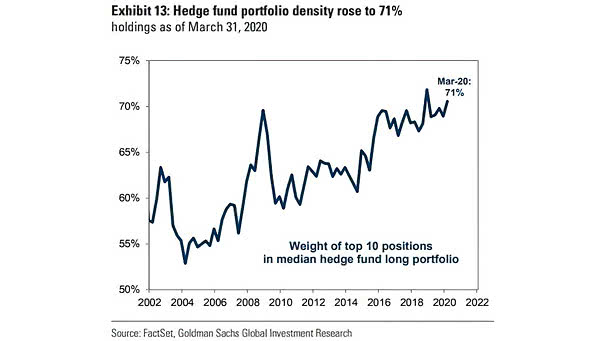

Weight of Top 10 Positions in Median Hedge Fund Long Portfolio

Weight of Top 10 Positions in Median Hedge Fund Long Portfolio The average hedge fund holds 71% of its long portfolio in its top 10 positions. This is one percentage point below the record high…