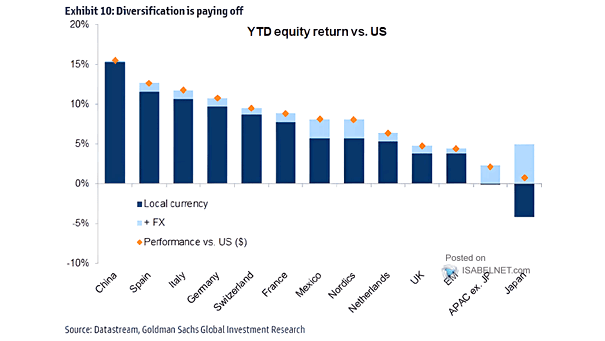

YTD Equity Return vs. U.S.

YTD Equity Return vs. U.S. In 2025, the relative outperformance of international stocks compared to U.S. equities has underscored the benefits of diversification for investors so far. Image: Goldman Sachs Global Investment Research