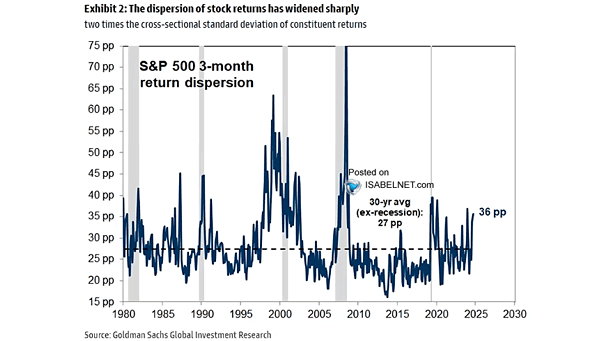

S&P 500 3-Month Return Dispersion

S&P 500 3-Month Return Dispersion S&P 500 return dispersion has risen above the long-term average in recent months, indicating that the gap between the best- and worst-performing stocks in the index has widened significantly. Image:…