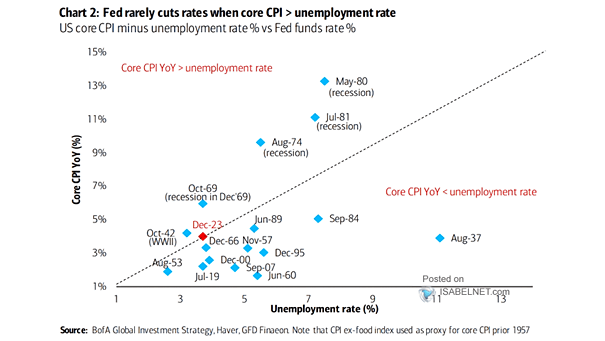

U.S. Core CPI Minus Unemployement Rate % vs. Fed Funds Rate

U.S. Core CPI Minus Unemployement Rate % vs. Fed Funds Rate The Fed rarely cuts rates when core CPI exceeds the unemployment rate, reflecting the central bank’s concern about potential inflationary pressures in the economy…