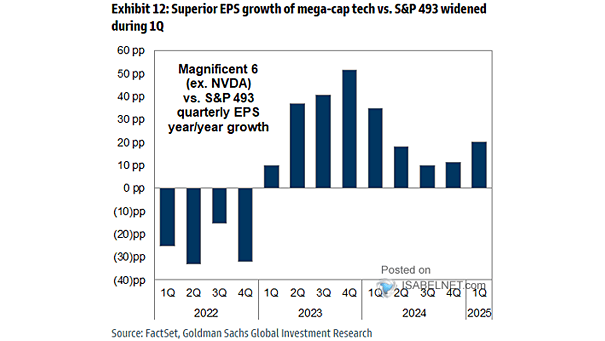

Performance of the Magnificent Seven Stocks

Performance of the Magnificent Seven Stocks Following a period of underperformance, the Mag-7 index has almost caught up to the S&P 500, reflecting regained investor confidence in U.S. AI giants despite the challenges posed by…