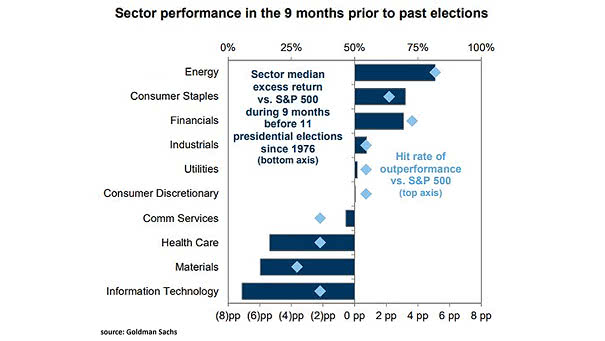

Sector Performance in the 9 Months Prior to Past U.S. Presidential Elections

Sector Performance in the 9 Months Prior to Past U.S. Presidential Elections This chart shows the sector median excess return vs. the S&P 500 during 9 months before 11 presidential elections since 1976. Image: Goldman…