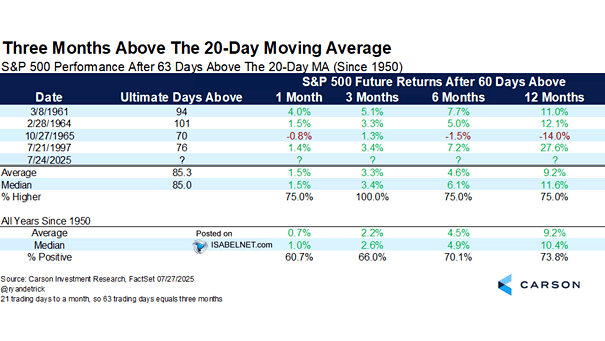

S&P 500 Performance After 63 Days Above the 20-Day Moving Average

S&P 500 Performance After 63 Days Above the 20-Day Moving Average After closing above its 20-day moving average for 63 straight days, the S&P 500 has, in the past, continued to rise over the following…