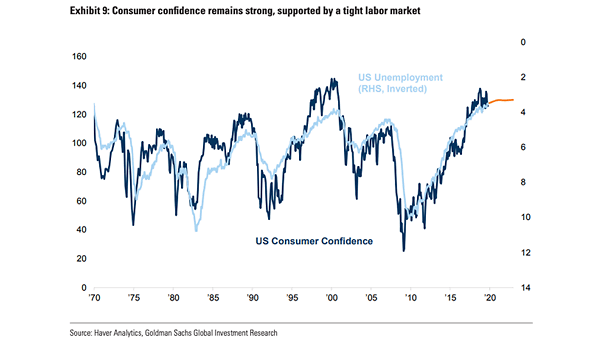

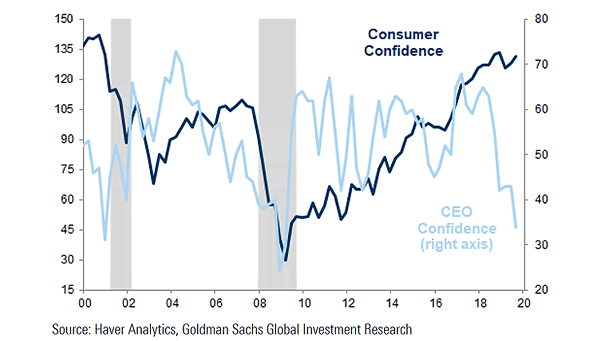

U.S. Consumer Confidence and U.S. Unemployment

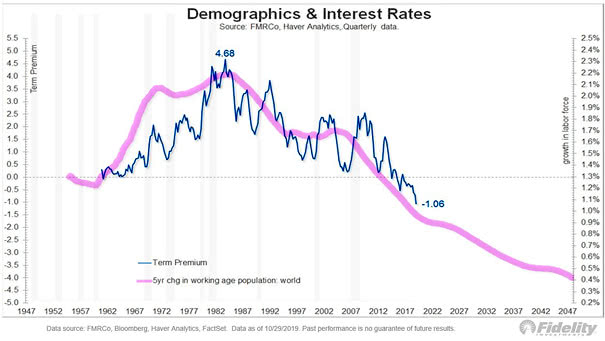

U.S. Consumer Confidence and U.S. Unemployment A tight U.S. labor market and low interest rates should continue to support U.S. consumer confidence and spending. Image: Goldman Sachs Global Investment Research