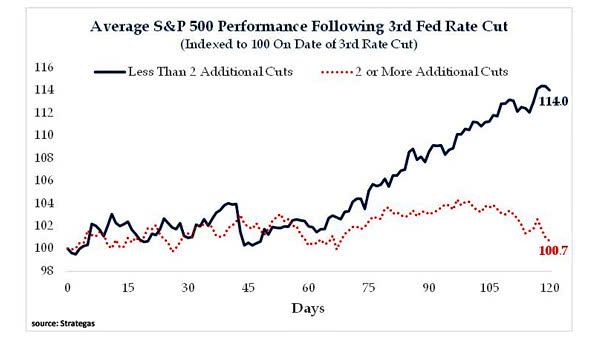

Average S&P 500 Performance Following 3rd Fed Rate Cut

Average S&P 500 Performance Following 3rd Fed Rate Cut In the Fed rate cutting cycle, the chart shows the average S&P 500 performance following a 3rd Fed rate cut, with less than two additional cuts,…