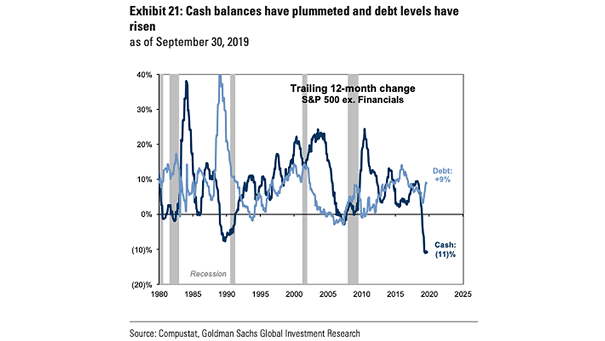

S&P 500 Cash Balances and Debt Levels

S&P 500 Cash Balances and Debt Levels During the past 12 months, non-financial S&P 500 cash balances have declined by -11% and debt levels have inflected higher by +9%. Image: Goldman Sachs Global Investment Research