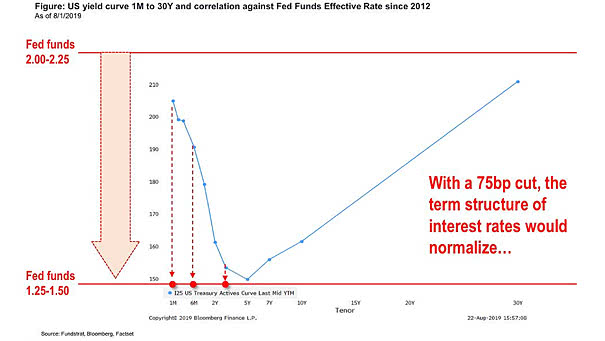

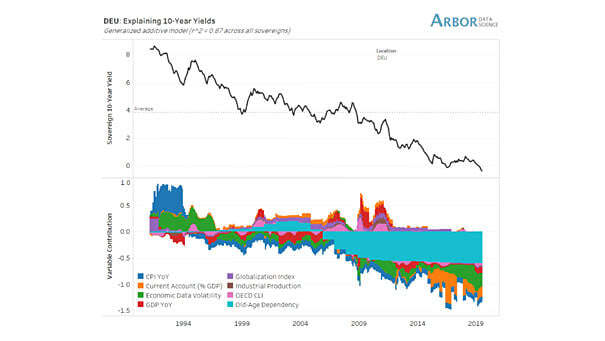

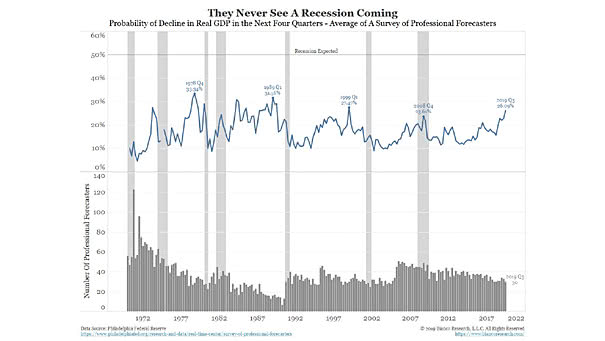

U.S. Yield Curve 1M to 30Y and Correlation Against Fed Funds Effective Rate

U.S. Yield Curve 1M to 30Y and Correlation Against Fed Funds Effective Rate According to the chart, a 75bp cut is required to normalize the term structure of interest rates. Image: Fundstrat Global Advisors, LLC