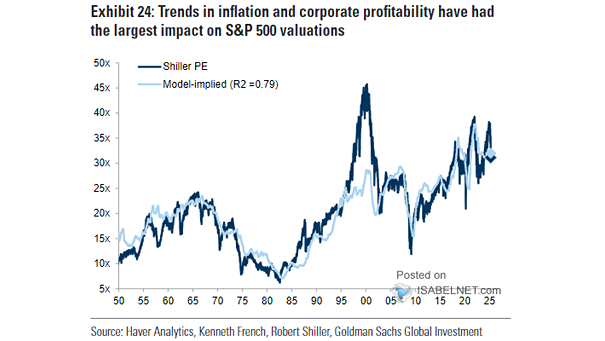

Valuation – Shiller Cyclically Adjusted Price/Earnings Ratio

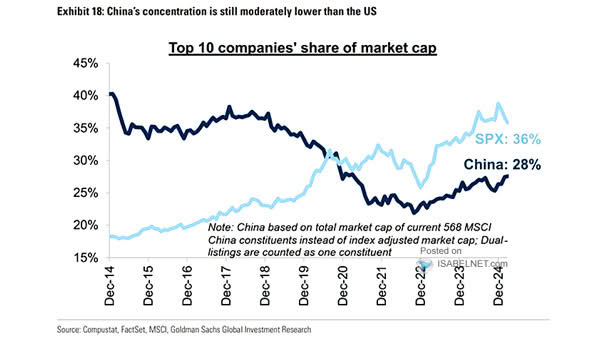

Valuation – Shiller Cyclically Adjusted Price/Earnings Ratio Higher inflation and lower corporate profitability structurally undermine the sustainability of U.S. equity valuations. Image: Goldman Sachs Global Investment Research