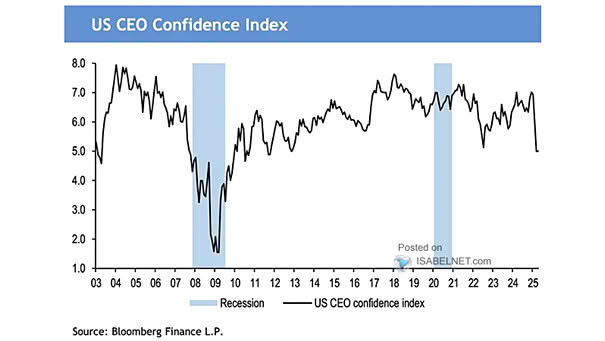

U.S. CEO Confidence Index

U.S. CEO Confidence Index The sharp decline in U.S. CEO optimism in 2025 is largely attributed to new tariffs, trade policy uncertainty, inflation, and unpredictable government actions, reversing the post-election optimism. Image: J.P. Morgan