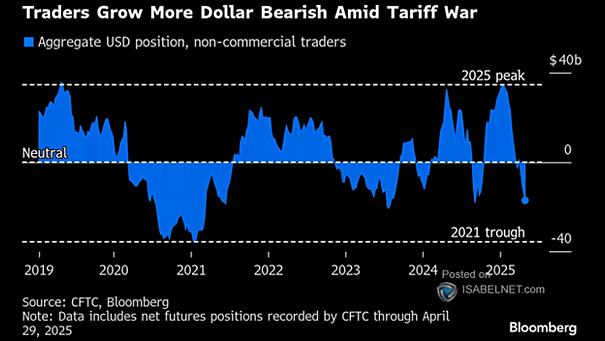

Aggregate U.S. Dollar Position, Non-Commercial Traders

Aggregate U.S. Dollar Position, Non-Commercial Traders Speculators are holding their most bearish positions on the U.S. dollar since September 2024, driven by global optimism, de-dollarization trends, and relative strength in other major currencies. Image: Bloomberg