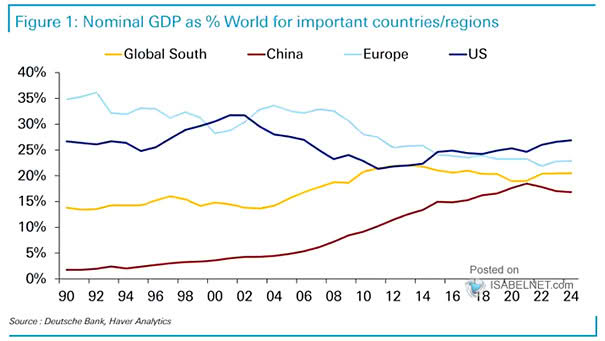

Nominal GDP as % World for Important Countries/Regions

Nominal GDP as % World for Important Countries/Regions The Global South is rapidly emerging as the primary driver of global demographic and economic growth. For investors and businesses, it presents expanding markets and new opportunities…