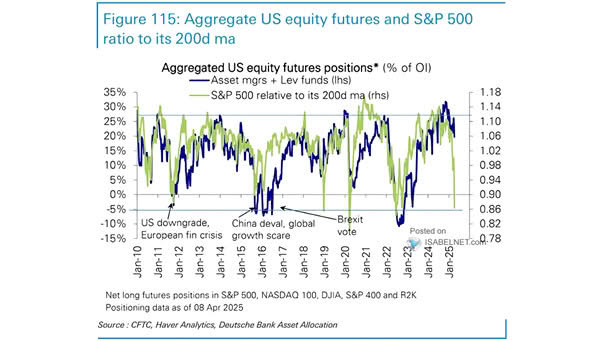

Aggregated U.S. Equity Futures Positions and S&P 500 Relative to Its 200-DMA

Aggregated U.S. Equity Futures Positions and S&P 500 Relative to Its 200-DMA While leveraged funds and asset managers have slightly scaled back their bullish stance, they still maintain substantial net long positions in U.S. equity…