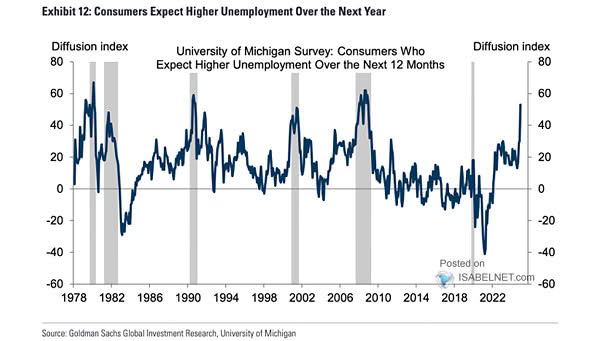

University of Michigan Survey – Consumer Who Expect Higher Unemployment over the Next 12 Months

University of Michigan Survey – Consumer Who Expect Higher Unemployment over the Next 12 Months The latest University of Michigan Surveys of Consumers indicate that a significantly higher share of Americans now expect unemployment to…