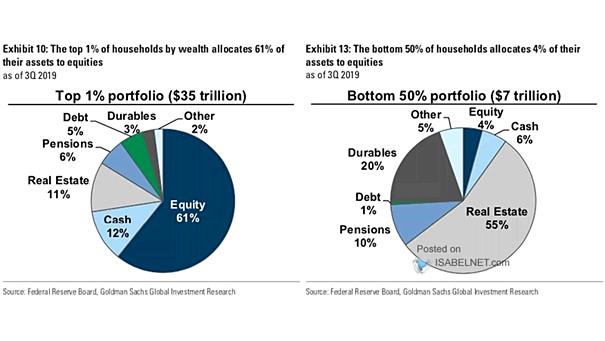

Equity Flows

Equity Flows U.S. equity flows have strengthened in early 2025, with investors pouring significant amounts of money into U.S. equity markets, aligning with analysts’ expectations of continued outperformance. Image: Goldman Sachs Global Investment Research