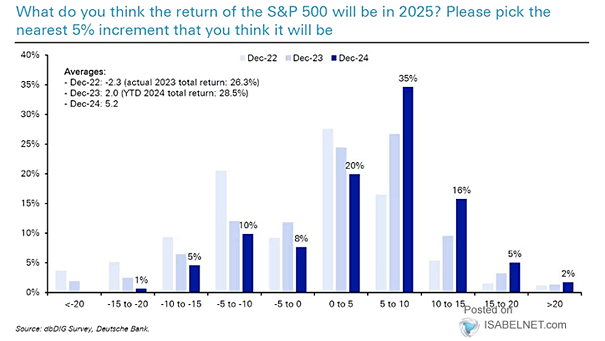

How Survey Responders Think the S&P 500 Will Perform Over the Year Ahead

How Survey Responders Think the S&P 500 Will Perform Over the Year Ahead 35% of respondents expect the S&P 500 index to appreciate between 5% and 10% by the end of 2025, while 24% expect it to decline, and 23% predict an increase exceeding 10%. Image: Deutsche Bank