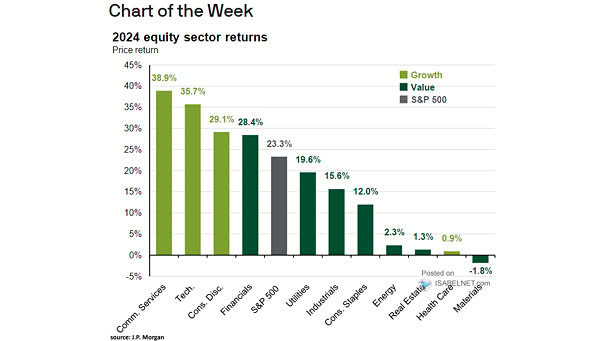

Equity Sector Returns

Equity Sector Returns While large-cap growth stocks, particularly those in the Magnificent 7, performed strongly in 2024, there was also a significant shift toward value sectors throughout the year, reflecting broader economic resilience. Image: J.P. Morgan Asset Management