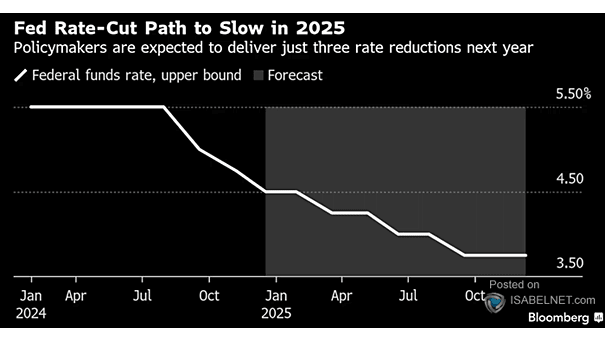

Interest Rates – Fed Funds Rate

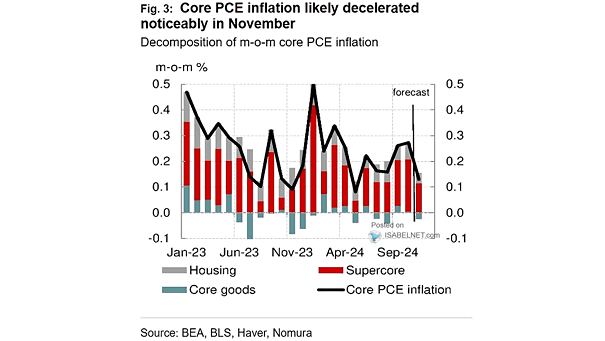

Interest Rates – Implied Fed Funds Target Rate The Fed is likely to cut rates by 25 basis points today, but projections for 2025 indicate a more gradual easing strategy, aiming to boost the economy while keeping inflation in check. Image: Bloomberg