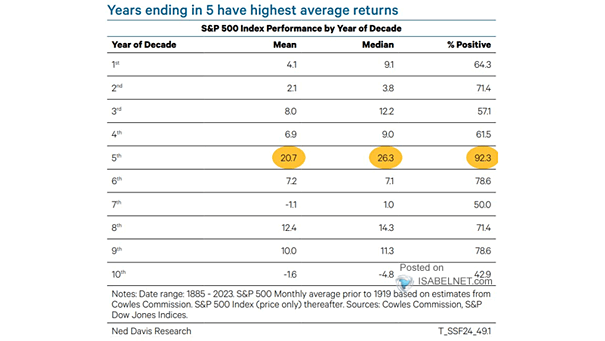

S&P 500 Index Performance by Year of Decade

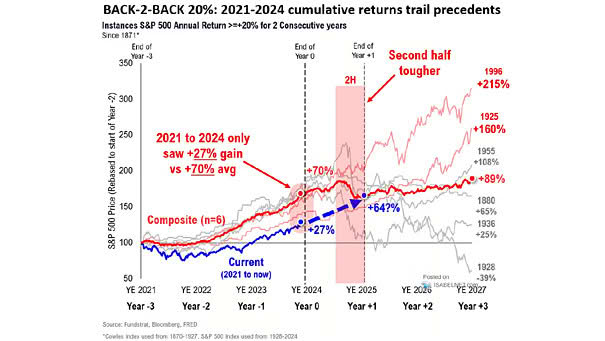

S&P 500 Index Performance by Year of Decade Bulls are smiling again, as years ending in 5 have historically been the most favorable for the S&P 500 index, with gains occurring 92.3% of the time and a median return of 26.3% since 1885. Image: Ned Davis Research