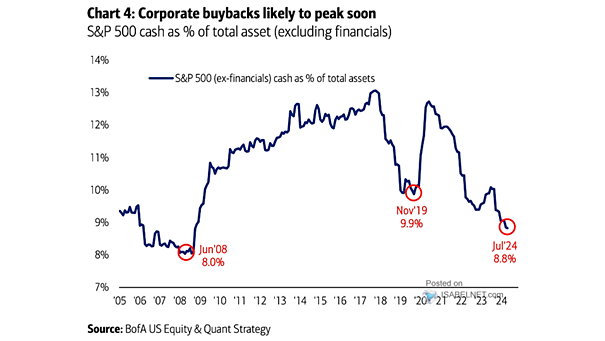

Cash to Total Assets S&P 500 and S&P 500 Ex-Financials

Cash to Total Assets S&P 500 and S&P 500 Ex-Financials The corporate cash cushion is thinning. S&P 500 firms have slashed their reserves from pandemic peaks, redirecting capital toward AI infrastructure, growth projects, and buybacks in a world where cash no longer comes cheap. Image: J.P. Morgan Equity Strategy and Global Quantitative Research