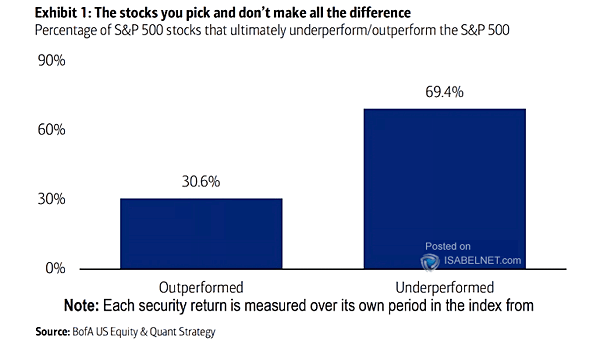

Percentage of S&P 500 Stocks That Ultimately Underperform/Outperform the S&P 500

Percentage of S&P 500 Stocks That Ultimately Underperform/Outperform the S&P 500 When it comes to investing in the S&P 500, the stocks investors choose make all the difference in their investment journey, as the right choices can significantly improve returns. Image: BofA US Equity & Quant Strategy