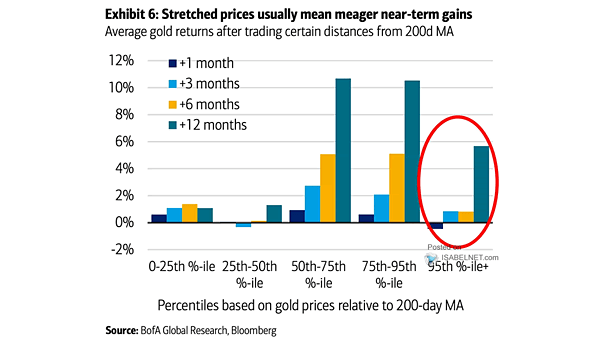

Average Gold Returns After Trading Certain Distances from 200-Day Moving Average

Average Gold Returns After Trading Certain Distances from 200-Day Moving Average Gold is currently 15% above the 200-day moving average, suggesting short-term bullish sentiment. However, historical trends indicate that investors should brace for potentially flat returns in the following 1 to 6 months after such extremes. Image: BofA Global Research