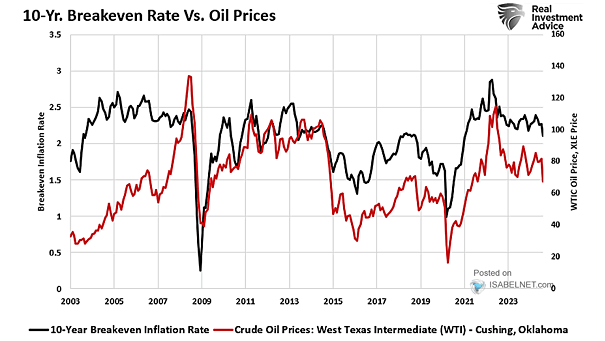

U.S. Breakeven Inflation Rates vs. Oil

U.S. Breakeven Inflation Rates vs. Oil U.S. breakeven inflation rates closely track oil prices, creating a complex challenge for the Federal Reserve as it navigates potential deflationary pressures in the coming months. Image: Real Investment Advice