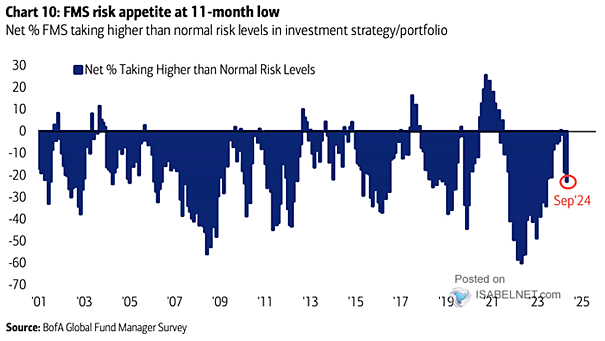

FMS Investors – Net % Taking Higher than Normal Risk Levels

FMS Investors – Net % Taking Higher than Normal Risk Levels In September, FMS risk appetite has significantly decreased, reaching a 11-month low. This decline reflects growing concerns among FMS investors regarding economic stability and market conditions. Image: BofA Global Fund Manager Survey