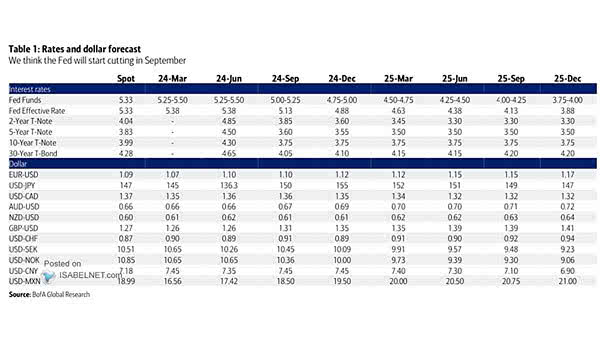

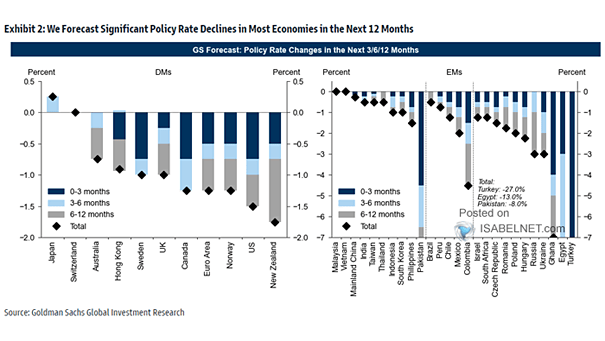

Rates and Dollar Forecast

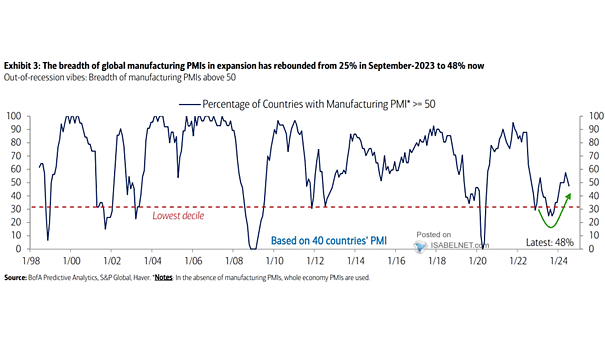

Rates and Dollar Forecast BofA expects the Fed to cut rates in September, adjusting its previous expectations. While market expectations for rate cuts have risen, the Fed hasn’t given a clear signal and will rely on data before making a decision. Image: BofA Global Research