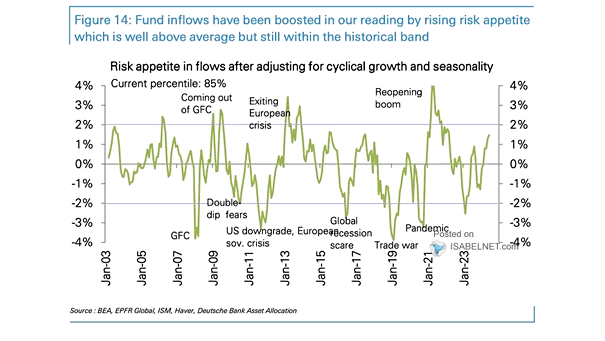

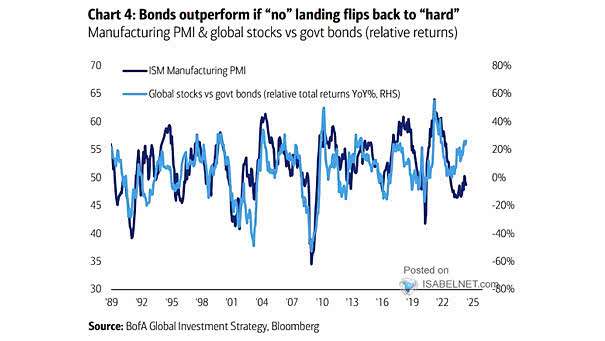

Risk Appetite in Flows After Adjusting for Seasonality and Cyclical Growth

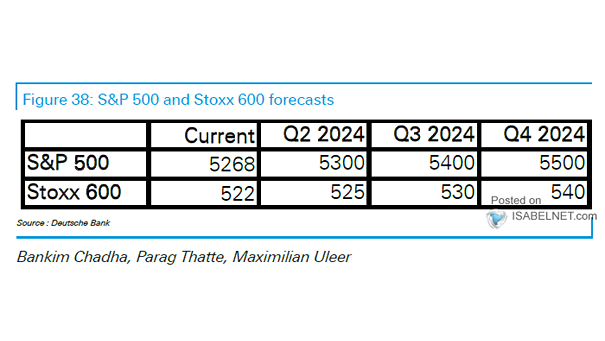

Risk Appetite in Flows After Adjusting for Seasonality and Cyclical Growth Market sentiment is currently robust, with risk appetite in flows at the 85th percentile, falling short of extreme levels. Image: Deutsche Bank Asset Allocation