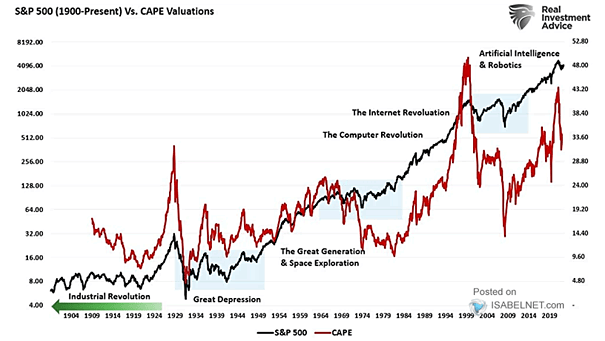

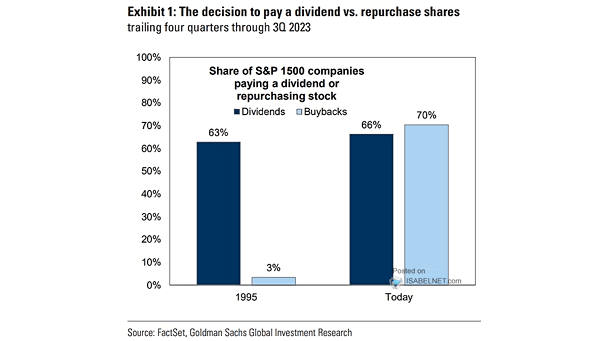

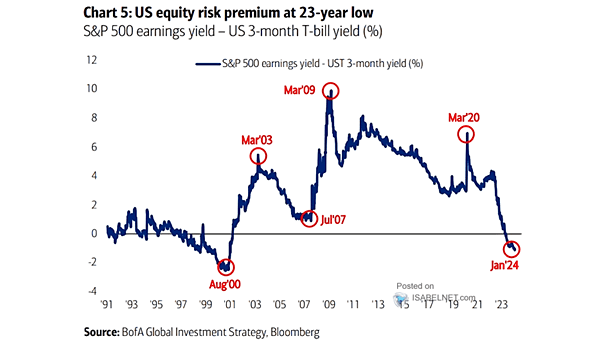

S&P 500 – CAPE Valuations

S&P 500 – CAPE Valuations While a high CAPE ratio can persist for extended periods without triggering a market correction, historical data suggests that such periods of elevated valuations are typically followed by lower stock market returns. Image: Real Investment Advice