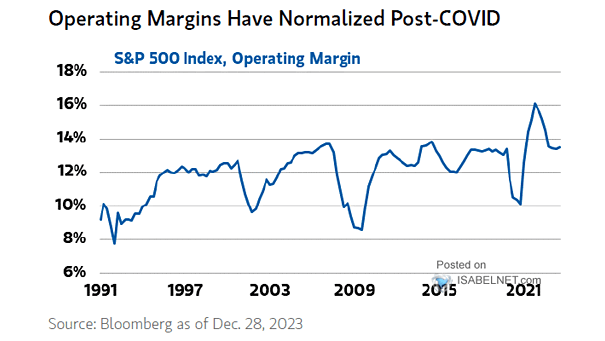

S&P 500 Operating Margin

S&P 500 Operating Margin After the COVID-19 pandemic, the operating margins of companies in the S&P 500 have returned to a state of normalcy, leading to a positive trend of improved profitability and cash flows for these companies. Image: Morgan Stanley Wealth Management