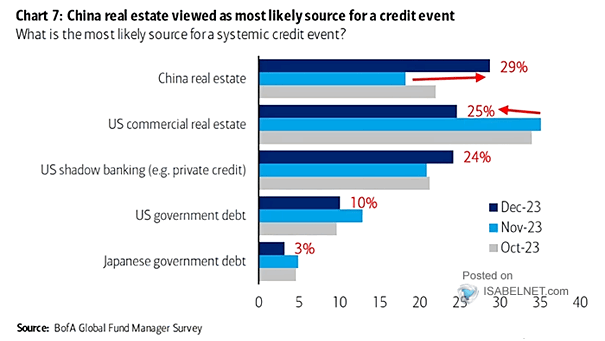

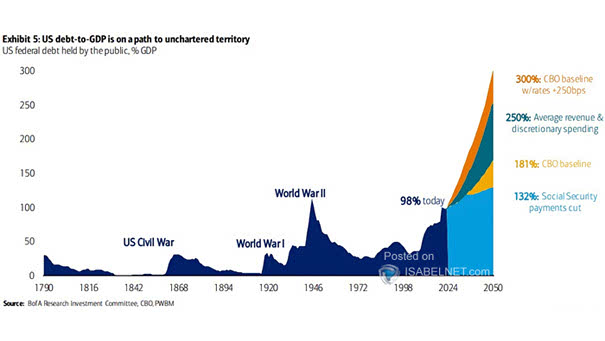

FMS Investors – What Is the Most Likely Source for a Systemic Credit Event?

FMS Investors – What Is the Most Likely Source for a Systemic Credit Event? FMS investors view the China real estate as the biggest source of a systematic credit event due to excessive borrowing, with significant implications for the Chinese economy and global consequences. Image: BofA Global Fund Manager Survey