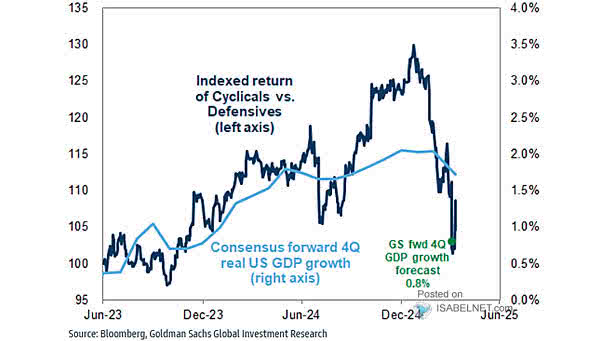

Indexed Return of Cyclicals vs. Defensives and Consensus Forward 4-Quarter U.S. GDP Growth

Indexed Return of Cyclicals vs. Defensives and Consensus Forward 4-Quarter U.S. GDP Growth The relative performance of cyclical stocks versus defensives currently signals market expectations for real U.S. GDP growth of 2%, below Goldman Sachs’ 2.6% forecast for 2026. Image: Goldman Sachs Global Investment Research