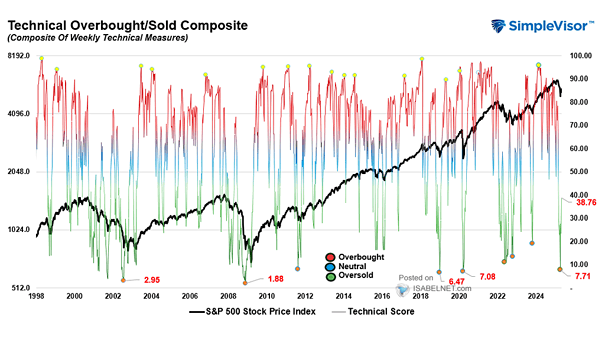

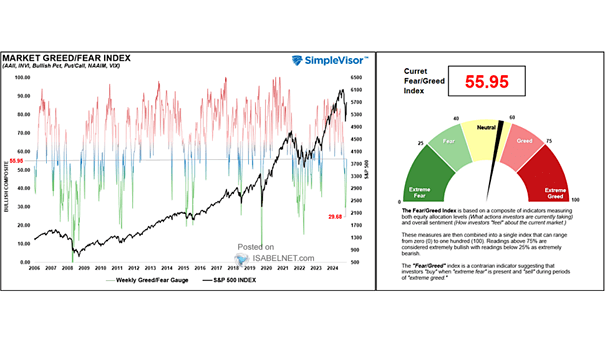

S&P 500 Index and Technical Score

S&P 500 Index and Technical Score With a reading of 74.58, the S&P 500 has continued to consolidate. Some weakness wouldn’t surprise anyone, but the broader tone still gives bulls the upper hand. Image: Real Investment Advice